georgia film tax credit requirements

Film tax credit In order to encourage the production of films in Georgia the state permits film production companies a credit of up to 30 of their qualified expenditures in Georgia. Instructions for Production Companies.

Essential Guide Georgia Film Tax Credits Wrapbook

A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns.

. 7 Fully Funded means that the seeking certificationapplicant can demonstrate that ithas assets that equal or exceed 75 of thetotal. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule. Before you begin please make sure you know the name of the Loan Out Company FEIN and the amount paid.

Withheld shall be deemed to have. Film Tax Credit The state offers a 20 tax credit which can be used against state income or Georgia withholding. 9 Entertainment products which have been approved and certified by GDEcD.

This 50000 would apply to current year or prior year taxes owed and any remaining amount could be carried over up to five years. The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits. Georgia Tax Center Information Tax Credit Forms.

Unused credits carryover for five years. Film Tax Credit. Both resident and non-resident workers payrolls and FICA SUI FUI qualify.

20 percent base transferable tax credit. Proof of funding the project has assets that equal or exceed 75 of the total budgeted cost of the project at the time the you apply Production company contact information. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

Credit Code 122 company name is the movie company no certificate 100 owner Federal EIN No and Credit Amount. Log into the GTC website httpsgtcdorgagov 2. The Georgia Entertainment Promotion Tax Credit GEP Tax Credit or GEP Uplift means the additional 10 tax credit which may be obtained for projects as outlined in Rule 159-1-1-07.

Key production personnels contact. No limits or caps on. Film Tax Credit Chapter 159-1-1 Draft 51021.

Any amounts so withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees for services performed in Georgia. The audit is requested through the Georgia Department of Revenue website GDOR and conducted on a first comefirst served basis. Isaiah recently joined the california film commission as the tax credit coordinator in 2018.

How to Complete a Withholding Film Tax Return via GTC Steps. The estimated base investment or excess base investment in this state. A tax certification is not required before January 1 2023 for credits of less than 125M.

How to File a Withholding Film Tax Return. On August 4 2020 Governor Kemp signed into law HB. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter.

20 base transferable tax credit. Most of the credits are purchase for 87-92 of their face value. Any qualified production expenditures claimed under the Postproduction Tax Credit or Musical Tax Credit are not eligible for the Film Tax Credit.

Third Party Bulk Filers add Access to a Withholding Film Tax Account. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit. 7-4026A effective January 1 2018 or the Musical Tax Credit codified in Code Section 48-7-4033 effective January 1 2018.

Rule 560-7-8-45 Film Tax Credit. 3 b The Georgia Entertainment Promotion Tax Credit GEP Tax Credit or GEP Uplift means the additional 10 tax credit which may be obtained for projects as outlined in Rule 1591- - 1-07. 2 Production Companies must create produce and record original content made in the State of Georgia in whole or in part to qualify for the Film Tax Credit.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. In most cases applications are reviewed and certified within 72 business hours. Film Tax Credit Chapter 159-1-1.

Georgia Department of Revenue Page 1 Withholding Film Tax Credit IMPORTANT NOTE. To apply for tax credit for live-action youll need. So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there value that would equal 44500.

159-1-1-01 Available Tax Credits For Film Video or Interactive Entertainment Production. There are two separate credits made available under the Act. The new law appears to be in response to an audit report issued by the Department of Audits and Accounts DOAA earlier this year that called into question the.

The Georgia Department of. Statutorily Required Credit Report. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA.

500000 minimum spend to qualify. Claim Withholding reported on the G2-FP and the G2-FL. For the 20 Film Tax Credit certification must be applied for within 90 days of principal photography.

A final tax certification is not required before January 1 2023 for productions seeking a 25M credit. Production expenditures must be made in Georgia from a Georgia vendor to qualify. This rule provides guidance concerning the application and qualification guidelines contained within the Georgia Entertainment Industry Investment Act hereinafter Act under OCGA.

The Department of Economic Development certification number. The film tax credit percentage amount either 20 percent or 30 percent. You will receive a red errorwarning message about K-1s which you can ignore.

How-To Directions for Film Tax Credit Withholding. Register for a Withholding Film Tax Account. Projects first certified by DECD on or after 1121 with.

GDOR requires the following. No limits or caps on Georgia spend no sunset clause. There is a tiered system that is based on the estimated tax credit value.

This informational bulletin provides examples of vendors that do not qualify as a Georgia Vendor under Revenue Regulation 560-7-8-45 Film Tax Credit and provides the effective date for the Georgia vendor provisions in Revenue Regulation 560-7-8-45. Production companies are required to withhold 6 Georgia income tax on all payments to loan-out companies for services performed in Georgia when getting the Georgia Film Tax Credit. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

If you make a. Projects certified on or after January 1 2023 are required to have a final tax certificate in order to use.

Essential Guide Georgia Film Tax Credits Wrapbook

Film Incentives And Applications Georgia Department Of Economic Development

Pin On Attracting A Job Vision Board

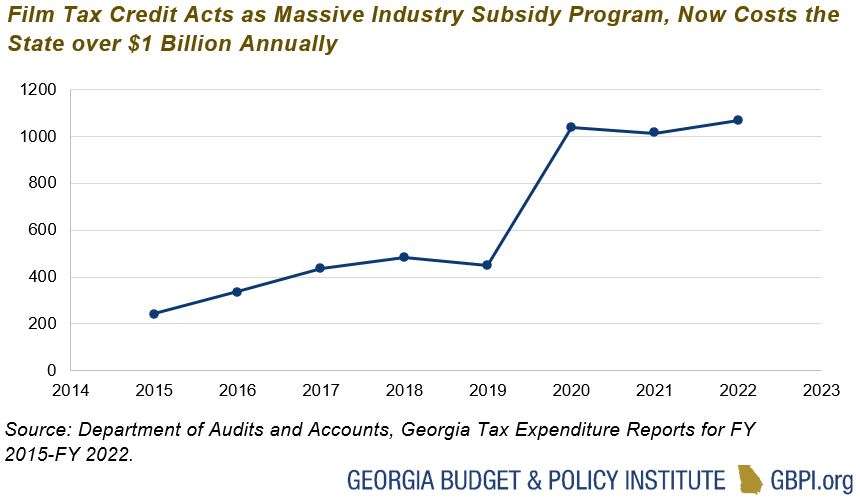

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

Celebrating The Georgia Film Industry Stranger Things Filming Locations Georgia Georgia On My Mind

The Bowery Went Down To Georgia Georgia Film Savannah Chat

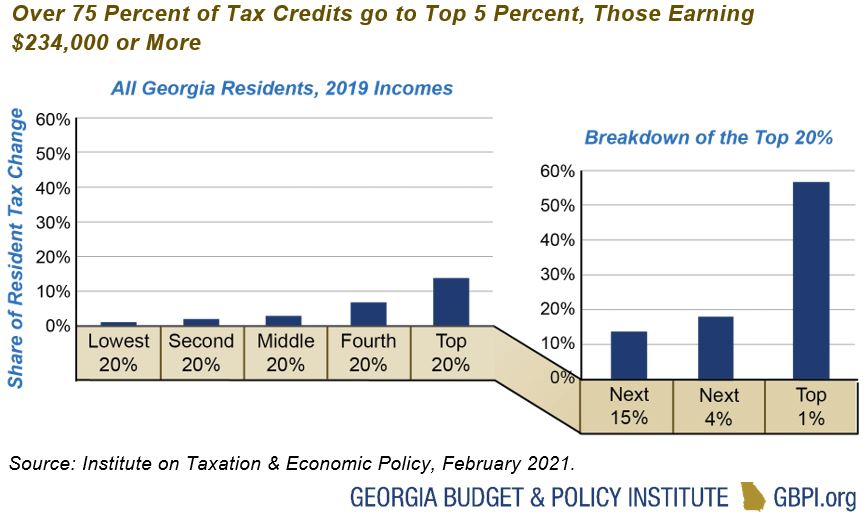

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

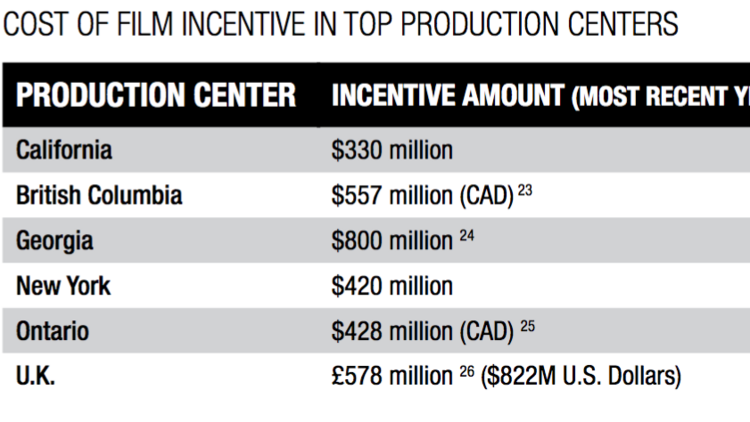

Georgia Film Tax Credit Could Be Capped Amid Fiscal Crisis Variety

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Georgia Senate Won T Cap Film Credit At 900 Million Variety

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle